Scientists at Stanford University in California and Purdue University in Indiana say global warming is going to hit hard in Corn Belt states where it most matters — the corn market. The study, financed by the U.S. Department of Energy, says that the corn market will be walloped in the coming years by climate change.

Factors such as market policies or oil prices have comparatively little effect on corn prices compared to global warming, the study says. In fact, heat waves sparked by rising global temperatures are expected to become more common, withering crops in the Midwest, scientists say.

Iowa Corn Market Expected to Stuggle Because of Global Warming

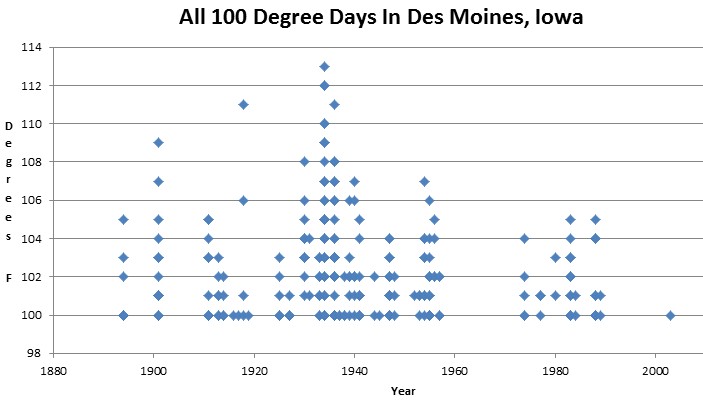

What utter stupidity. The graph below shows all of the 100 degree days recorded at the USHCN station closest to Des Moines, Iowa. All but one occurred below 350 ppm CO2, and the hottest decade (by far) was the 1930s. Before USHCN “adjustments,” the past decade had some of the coolest summer afternoons on record in Des Moines.

People pay nearly $50K per year to send their kid to Stanford. For what? To teach them the scientific skills of a Kentucky Fried Chicken dropout?

What nonsense. Stanley Jevon’s corellated data on changes in crop yields with changes in temperatures to demonstrate that high crop yields were corellated with higher temperatures. Indeed, he used data on crop yields to develop a temperature proxy.

Corn likes moderate heat, but if it goes over 100 for more than a few days, the yields start going sharply down. Even with adequate rain, 100+ heat for any length of time will reduce yields significantly. Extended periods of 95 degree heat will also reduce yields.

This article is all over the map;

The corn market is already struggling with an over-supply, as more acreage has been planted in the United States than any year since 1937, according to one government estimate. The abundance in supply has contributed to a drop in prices.

The scientists say policies do make a difference, particularly government mandates surrounding the corn market. Federal biofuel mandates, for example, are contributing to the oversupply of corn, and could make it difficult in future years for farmers to adjust to volatile yields, they say.

So there are problems with over-supply caused by Federal biofuel mandates – and we need “scientists” to point out this obvious fact? What am I missing?

As for rising temperatures from Man-Made-Global-Warming, the chart above shows no spectacular warming in the mid-west – just too much corn on the market right now.

Iowa’s republican senator notes: “I think the temperature rose between 1700 and 2000,” (Iowa republican senator) Grassley said. “You can measure that. But in the last 10 years, there’s been no increase. So I guess we need a longer trend. And we need more scientific certainty to the extent which it’s natural and to the extent which it’s man-made.”

Thankfully someone has some sense – certainly not the so-called scientists in this case.

This is a preemptive strike to what the policies have created. Prior to the ethanol mandates, the corn market was stable and strong with steadily increasing yields. The ethanol mandates then created a huge demand for corn, so the farmers grew corn and heavily invested in specializing in corn. Now, demand is petering out. Leaving the farmers in some dire straits. With the prices dropping, there isn’t enough acreage for the farmer to pay for his new combine with corn harvesting heads.

The experienced and good farmers will weather the storm, the marginal farmers will not. We led them down the primrose path only to pull the rug out from under them.

The only way to end the volatility is to decouple corn from gas prices. Nearly 1/2 of our corn yields go to ethanol. And while Grassley is making sense now, he was one of the many who jumped at the opportunity to make the ethanol mandates. The current price of gas should keep the price of corn from hitting rock bottom, but the fact is we told them to grow corn, and our farmers are the best in the world. So, grow corn is what they did. We should never play with our food.

Corn is a $100 million a year product in SOUTH FLORIDA. Yes we grow corn here. Yes it’s hot here.

Notice how no scientists are named. Notice how they do not consider the implications of a cooler climate. Notice how they assume that heat waves are becoming more common – though the empirical evidence says otherwise.

“Factors such as market policies or oil prices have comparatively little effect on corn prices compared to global warming, the study says.”

Of course, funneling 40+% of our corn into heavily subsidized ethanol fuel production has no effect on the corn market prices. Noe. Nothing. Nada. Nah, can’t be.